How Health Systems Can Avoid Buying a ‘Lipsticked Pig’

When acquiring new medical office buildings, health systems and other property owners risk purchasing “lipsticked pigs.”

That’s according to Fredric Lastar, vice president of healthcare solutions at JLL. By “lipsticked pigs,” Lastar means medical office buildings that may appear in good condition to the naked eye, but really have several issues that will be costly for the new owners to fix.

These issues may be exacerbated by the fact that many soon-to-be former owners of medical office buildings have little incentive to maintain the properties once they know they’re going to be sold.

“They’ll stop maintaining the buildings—they’ll stop doing a lot of things—when they know that in 6 to 8 months they’ll be a part of a different organization,” Lastar said during a presentation at the recent Midwest Health Care Real Estate 2017 event in Chicago.

To avoid purchasing less-than-stellar properties, early and thorough building assessments are absolutely critical, Lastar said. Convincing a C-Suite of this may be easier said than done, however.

“The C-Suite makes their decisions based on business needs, not building conditions,” Lastar explained. “Oftentimes, they don’t look at the implications of what they’re acquiring.”

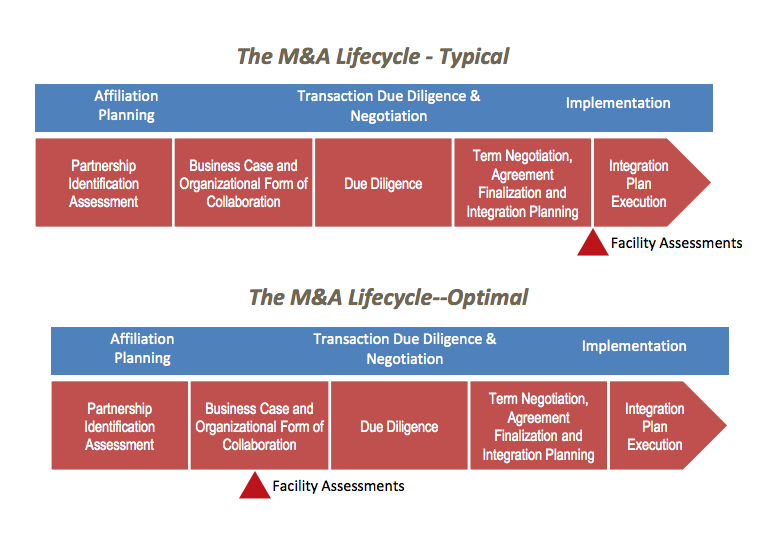

According to Lastar, many companies that are acquiring new medical office properties conduct due diligence once they’re starting to actually take over the new properties.

“That’s wrong,” Lastar said.

Instead, due diligence should be conducted much earlier on, he explained.

“If there’s $160,000 or $180,000 required to bring some parts of the building up to code, that’s something that should be done as a part of the merger or acquisition; that’s not something that should be done by the acquired facility after the fact,” Lastar said. “Those should be costs that are factored into the merger.”

Written by Mary Kate Nelson