97% of Health Care Real Estate Investors Interested in MOBs

Investors in the health care real estate industry seem especially keen on buying medical office properties this year, according to the U.S. Healthcare Capital Markets 2017 Investor & Developer Survey, recently published by commercial real estate services and investment firm CBRE Group, Inc. (NYSE: CBG).

For the survey, CBRE polled a total of 91 institutional investors, private capital investors, health care real estate investment trusts (REITs) and developers across the country.

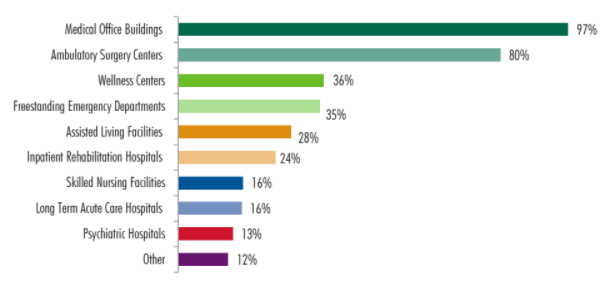

Approximately 97% of respondents, when asked to name all health care real estate properties that currently meet their acquisition criteria, indicated an interest in medical office buildings.

About 80% of the respondents, meanwhile, said they were interested in acquiring ambulatory surgery centers, while 35% said they were interested in acquiring freestanding emergency departments.

As it turns out, acquisitions will be a focus for many companies in the health care space this year.

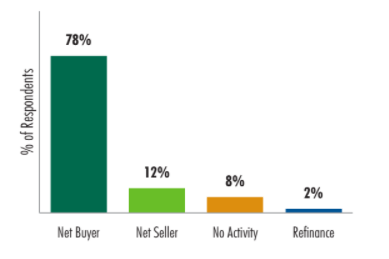

Just 12% of respondents indicated that they plan to be net sellers of medical office buildings in 2017, the survey reveals.

About 78% of the survey’s respondents, on the other hand, expect they will be a net buyer of medical office buildings in 2017. Of those respondents, 24% are from health care REITs, 20% are from health care real estate developers, 31% are from private capital investors, 17% are from institutional capital, and 8% are from equity funds, corporations or banks.

The value of on-campus, Class A medical office buildings remains high, as 49% of the survey respondents said that cap rates for these core assets are expected to below 6% this year. The cap rate spread between core Class A and Class B medical office product still exists, CBRE notes in the report, but the cap rate spread between Class A on-campus and off-campus product types has narrowed from 2016 to 2017.

This may have something to do with where new medical office buildings are being built, CBRE believes.

“We believe this reflects the growing supply of high-quality medical office buildings that are health system mission-critical assets strategically located away from hospital campuses and positioned in affluent, high-growth, suburban, secondary and tertiary markets as health care providers continue to locate themselves closer to patients’ residences,” the report says.

Approximately 67% of respondents anticipate that cap rates for Class B off-campus product will be between 6.5% and 7.49% in 2017.

All the while, respondents believe that supply and demand for all of the different health care real estate asset types will stay about the same in 2017 as in 2016.

With respect to medical office buildings, about 58% of respondents believe that the assets will have the same supply in 2017 as in 2016, and 53% of respondents expect that demand will be the same. Still, 45% of respondents believe that demand will be higher in 2017 than in 2016.

Written by Mary Kate Nelson