Medical Office Vacancy Rate Hits Record Low 7.4%

Last year saw very strong demand for medical office properties. In fact, the national vacancy rate for medical office buildings fell to a record low of 7.4% at year-end 2016, according to a recent report from Colliers International.

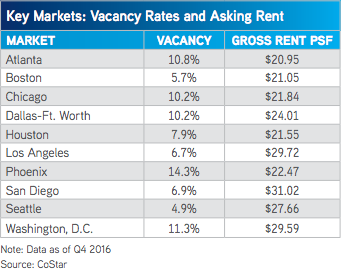

In markets like Los Angeles, San Diego and Boston, the vacancy rates were below 7%; in Seattle, the vacancy rate hit 4.9%.

Though the national vacancy rate signifies ample demand for medical office assets, the properties in some markets have fared better than those in others. Chicago, Washington, D.C., Atlanta and Phoenix all had vacancy rates above 10% at the end of 2016, for instance.

Medical office building net absorption, meanwhile, jumped 25% from 18.1 million square feet in 2015 to 22.7 million square feet in 2016—the highest annual total since 2008, the report says. At the same time, full service gross (FSG) medical office building rents increased by 8% to a national average of $24 per square foot in 2016.

Last year also saw a near-record number of new medical office buildings coming online. More than 22 million square feet of medical office space was delivered in 2016—that’s up from 14.6 million square feet of deliveries in 2015, and just below the 2008 high of 24.9 million square feet. Still, because this new supply represents just 1.7% of the total medical office building universe, it’s “still modest” in terms of inventory, the report says.

Total investment in medical office buildings declined from $11.6 billion in 2015 to a “still-respectable” $9.3 billion in 2016, the report notes. Average medical office building cap rates dropped slightly to 6.7% in 2016 from 7% in 2015. The value of medical office space fell from an average price per square foot of $252 in 2015 to $239 in 2016.

Still, the lower value of medical office space does not indicate wavering interest in the sector as a whole.

“Despite the slight drop in average price, the lower cap rate suggests the dip in transaction volume is likely the result of a slightly lower supply of investment-quality product available for purchase, rather than a lack of interest in the sector,” the report says.

Written by Mary Kate Nelson