Medical Office Completions to Spike in 2017

Plenty is in store for the medical office industry this year, according to a recently published report from Marcus & Millichap.

More specifically, 2017 will see the industry change in several ways, including when it comes to who’s buying medical office space, how much medical office space is being completed and the amount of money landlords will be charging for it.

For instance, both real estate investment trusts (REITs) and institutional funds are actively seeking out larger medical office deals and portfolios, the report says. At the same time, private capital—currently “a major option in the $5 million to $20 million price tranche”—may begin to participate in a bigger share of medical office deals in 2017.

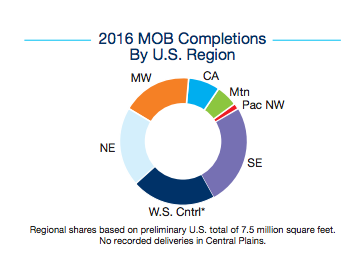

This year will also be busier than last in terms of new construction. More than 8.5 million square feet of medical office space is scheduled for completion in 2017, which is up from the 7.5 million of medical office space completed in 2016. Additionally, approximately 2.1 million square feet of the medical office space built this year is expected to be in the Midwest. In 2016, medical office completions were primarily concentrated in the Southeastern part of the country.

Average medical office rent is expected to rise 0.3% to $22.81 per square foot by the end of 2017, the report adds.

Currently, the most active lenders in the medical office sector are national banks, which provide financing for large institutions and private parties alike. Leverage for medical office assets, meanwhile, can be as high as 75%, with interest rates ranging between 3.75% and 4.5%, the report notes.

Lately, absorption has been concentrated in medical office assets built after 2000, the report says. Because of this, older-vintage assets will “bear the brunt of attrition” in the coming year.

Written by Mary Kate Nelson